1. Foreign holdings of Treasuries hit a record high of $7.75 trillion in November, with total holdings up $88.8 billion from a month earlier, according to the latest data released by the US Treasury. Of this total, Japan’s holdings of US Treasuries rose by $20.2 billion to $1.3 trillion in November, while China’s holdings of US Treasuries rose by $15.4 billion to $1.08 trillion in November.

2. According to an opinion poll released by CBS on the 16th, only 25% of people are satisfied with Biden’s one-year job.

3. Since the Federal Reserve released the minutes of its December FOMC meeting in early January, market participants generally expect FOMC to accelerate cuts in Treasuries and institutional mortgage-backed securities (MBS), asset purchases will end in March 2022, and the target range for the federal funds rate will be raised for the first time from the first quarter of 2023 to June 2022. Subsequently, the Fed raised interest rates in March as a consensus in the market; then there were voices in the market that the Fed raised interest rates not only three times this year, but that “four or even five interest rate increases are appropriate, maybe six or seven times.” earlier today, money market prices show that the Fed has the possibility of raising interest rates by 50 basis points at once.

4. As energy prices continue to soar, the average energy bill of British households will nearly double year-on-year to an annual average of £2000 by April, and the number of households trapped in “energy poverty” will triple, according to a British think-tank. If the UK government is to offset the impact of soaring energy prices on household spending, it will need a subsidy of at least 7 billion pounds, or about $9.6 billion, this year.

5. Due to the rapid spread of the Omicron mutant strain, the number of people asking for leave or resigning from various industries in the United States is increasing. Recently, a total of 13000 McDonald’s restaurants across the United States have had to reduce their business hours by an average of 10% due to a severe shortage of staff, and several fast-food chains such as Starbucks and burritos have also restricted their business hours.

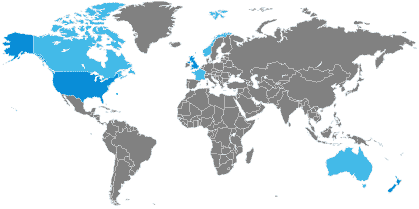

6. On January 19, Britain and the United States said they had begun formal negotiations on US tariffs on British steel and aluminum exports during the Trump administration. Trade officials in both countries said they were committed to “quick results”, which would help protect metal manufacturers in both markets. The United States is likely to abolish steel tariffs on Britain in the future, a move that is expected to end retaliatory tariffs on American whisky. It is understood that trade disputes have always been a long-standing estrangement between Britain and the United States. Last year, the United States reached an agreement to abolish the “metal border tax” on European countries.

7. According to a recent report on the website of the French newspaper Echo, the White House had planned to celebrate the low unemployment rate of 3.9% last year and the historic economic growth rate, but in the end inflation stole the limelight. In December, the US consumer price index (CPI) rose 7 per cent from a year earlier, the biggest year-on-year increase in 40 years and more than 6 per cent for the third month in a row. In fact, CPI has been moving up the ladder since the second half of 2020. According to statistics, US CPI dropped from 2.5 per cent to 0.1 per cent from January to May in 2020, but rose slowly from 0.6 per cent to 1.2 per cent from June to November, and CPI soared from 1.4 per cent to 5 per cent from December 2020 to May 2021 and rose from 5.4 per cent to 7 per cent from June to December.

8. A study published in the Medical Journal of the American Heart Association says that owning a dog can help improve the prognosis of cardiovascular disease, and dog owners have a 24% lower risk of all-cause death than people who do not own a dog. Kramer, an endocrinologist at the University of Toronto in Canada, said that owning a dog can increase physical activity, reduce depression and loneliness, and improve physical and mental health.

9. Does the US government extend its “black hand” to Ali Yun? The US government is reviewing the cloud storage business of Chinese e-commerce giant Alibaba to determine whether it poses a risk to US national security, Reuters reported Monday. Us regulators may ban Americans from using Aliyun’s business, according to sources. Alibaba said it would not respond.

10. The White House has warned US chipmakers that the US could restrict chip exports to Russia if tensions between Moscow and Kiev escalate.

11. Global venture capital financing “rush” in 2021. Given the unprecedented loose monetary policy of central banks and the trend of excess liquidity, the epidemic did not hinder venture capital in 2021. Although the statistical methods are different, many analysts have come to a more consistent conclusion: the global venture capital financing will set another record in 2021. The latest report from CB Insights, a venture capital database, shows that global venture capital funding reached $621 billion in 2021, more than double the $294 billion in 2020, while the latest reports from research firm Dealroom and the London Development Promotion Agency also show that start-ups received an unprecedented $675 billion in 2021, doubling from 2020.

12. Inflation in Canada, Germany and the UK climbed to their highest level in about 30 years, leading to increasing pressure on central banks to tighten monetary policy, according to the latest data released by Canada, Germany and the UK on the 19th. The Canadian Consumer Price Index (CPI) rose 4.8% year-on-year in December 2021, slightly faster than the 4.7% increase in November that year, Statistics Canada said on the 19th. TD Securities said the country’s December CPI data were in line with market expectations. Excluding petrol, CPI rose 4 per cent in December from a year earlier. The last time Canadian prices rose more than 4.8 per cent year-on-year was in September 1991, when CPI rose 5.5 per cent.

Post time: Jan-21-2022