1. On October 12, local time, the Federal Reserve Bank of New York released a report saying that the median expectation of US consumers for the inflation index in the coming year reached 5.3%, rising for 11 consecutive months and reaching an all-time high. Nevertheless, Federal Reserve Chairman Colin Powell insists that inflation is only temporary and that the Fed will not cut federal interest rates as a result.

2. Although inflation in the euro zone reached 3.4% in September, a 13-year high, the ECB’s chief economist Rehn said on the 11th that the ECB has no intention of adjusting monetary policy at present.

3. The International Monetary Fund predicts that China’s economic growth is expected to reach 8% in 2021, 0.1 percentage points lower than the July forecast, and 5.6% in 2022, 0.1 percentage points lower than the previous forecast.

4. The European Commission announced the issuance of the first 15-year green bond, raising a total of 12 billion euros for green and sustainable investment in 27 EU member states. The European Commission said the green bond had been subscribed for more than 135 billion euros, setting a global record in terms of market demand and issuance.

5. The Federal Reserve released the minutes of the September meeting of the Federal Open Market Committee (FOMC) on Oct. 13, local time, further confirming the Fed’s expectation of “gradual debt withdrawal” in three weeks’ time. The minutes show that the Fed could start scaling back its monthly asset purchases as early as mid-November.

6. International Energy Agency: global coal demand will peak around 2025 and then fall by 25% in 2050. The climate commitments of governments are insufficient to achieve the objectives of the Paris Agreement. By 2030, the world must triple its investment in clean energy to curb climate change.

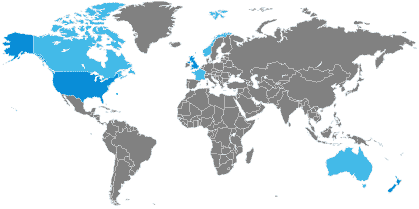

7. The International Monetary Fund (IMF) released its latest global forecast on the 12th local time, saying that compared with other developed countries, the COVID-19 epidemic has dealt a more lasting and severe blow to the British economy. The group predicts that the UK economy will still be 3 per cent smaller by 2024 than it was before the outbreak, ranking at the bottom of all G7 countries, while other G7 countries, such as the United States, Canada and Japan, will return to pre-epidemic levels.

8. Russian Prime Minister Mishuskin said: “Economic and trade cooperation plays a key role in the development of Russian-Chinese relations. In 2021, the trade volume between the two countries will maintain strong growth. From January to July, it increased by 29% to US$74 billion. This situation leads us to believe that record levels are expected to be reached this year. The goal of increasing the trade volume to 200 billion US dollars put forward by the Chinese and Russian leaders will be achieved in the near future. “

9. The Entertainer, one of Britain’s largest toy retailers, has warned that severe congestion and freight delays at UK ports will lead to a shortage of toys for traditional western festivals this year. There is a growing backlog of containers at terminals, including Felixstow, Britain’s largest port. The crisis has triggered widespread concerns among retailers about future inventories.

10. South Korean technology giant Naver: invested 11.3 billion won, or about US $9.52 million, in Gaudio Lab, an audio technology company in Yuan Cosmos. Through this investment, Naver will cooperate with Gaudio Lab to train technical personnel and lock in the global metacosmos audio market.

11. Alitalia will be officially closed. After years of relying on Italian government support, the COVID-19 epidemic became the last straw to crush the company. In the late 1960s, Alitalia was the third largest airline in Europe, after British Airways and Air France.

Post time: Oct-15-2021